We’ve written before about problems with the way a microfinance institution’s “repayment rate” is commonly cited. We’ve been surprised to find that most institutions do not report what most of us would think of as a “repayment rate,” i.e., the percentage of loans/dollars due that have been paid on time. Instead, they report proxies such as “portfolio at risk” that can (theoretically) be very different.

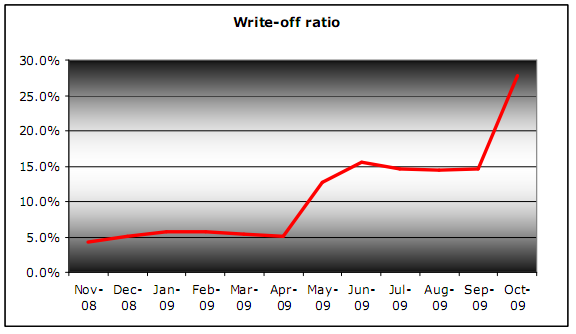

We now have an example of just how different they can be. ID-Ghana, a microfinance institution, has given us permission to post its application for funding from GiveWell. Page 2 discloses that “The write-off ratio has shot up lately because of the clean up that followed the phase out of our old loan products which proved to be inefficient and impactless,” yet the repayment ratio is reported as 99% (same paragraph). That’s because the definition of “repayment ratio” being used ignores loans that have been defaulted on and written off. Only “at-risk” (but still-on-the-books) loans lower this “repayment ratio.”

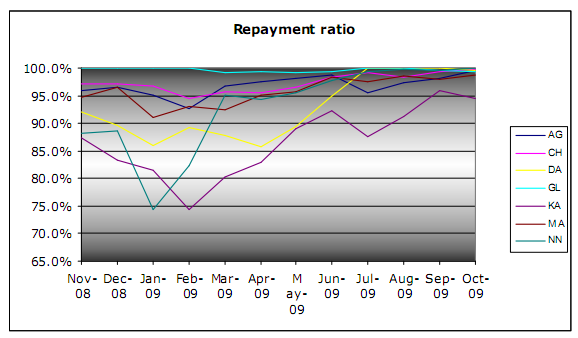

These charts show how drastic the disrepancy is, particularly from June 2009 on:

To be clear, we think ID-Ghana’s reporting is entirely consistent with standard reporting practices. To a large degree, that’s what worries us. By industry standard reporting practices, a 99% “repayment ratio” can be consistent with a 30%+ default rate – and is in this case.

This is why we’ve insisted on requesting what we call the “real repayment rate”, defined as the percentage of loans that have been paid off on time divided by the percentage of loans that have come due over a given time period (“loans” here can refer to number of loans or dollars lent).

What has shocked us is how few microfinance institutions are able to provide the real repayment rate. In fact, all of the major U.S. microfinance institutions we’ve contacted (excluding FINCA, which declined to apply for funding at all) have explicitly told us that they cannot or will not provide real repayment rates for their partners.

We’ll be writing more about the Small Enterprise Foundation, the only institution that we’ve seen be fully clear about its repayment rate.

Comments

GiveWell would do well to familiarize itself with why the industry uses certain indicators (PAR) vs. others (repayment rate) and the implications.

On time repayment rate is easy to understand but conceptually offers little to investors or donors. Let’s say all clients make payments 1 day late. In this case, on time repayment would be 0% but writeoffs/default would be 0% as well. Portfolio at Risk (PAR) is used to capture the total portfolio that may default in the future (indicated by some delinquency already on the loan). This allows for sensitivity analysis on the hit to the balance sheet and allows donors and investors to age the arrears and portfolio at risk to see how bad the delinquency is. Depending on the underlying characteristics of the loan (type, repayment frequency, etc.), different aging is acceptable.

Perhaps all MFIs are not “transparent” about this metric because no one uses it and some fairly intelligent people have created appropriate indicators to measure the core underlying issue: delinquency.

Ben, I agree that PAR is more useful for measuring the financial situation of an institution – its risks, capital needs, etc. But I disagree that this is the only information of interest to donors.

A high repayment rate is often taken as an indicator that clients are participating in a healthy and successful way (not just that the institution is in solid financial shape). I’d guess that most who cite high repayment rates as evidence that “microfinance is working” have this meaning in mind (it wouldn’t make much sense for them to claim that “microfinance is working” based on low PARs, which in isolation simply indicate that a given institution’s position is unlikely to worsen significantly in the short term).

The ‘real repayment ratio’, as you have it defined, would seem to depend on the terms of the loans and the reporting period chosen. An MFI offering 3-month loans could have very different ‘real repayment ratios’ from an MFI offering 6-month (or 12-month) loans, even if the borrowers missed payments at the exact same times. Since loan terms vary greatly across MFIs, this makes meaningful comparison of the ratio impossible and is one reason this metric is not used more widely.

Ben’s comment describes well how PAR ratios can provide meaningful information at a single point in time on the potential for future losses. Write-offs tell you about realized losses over a period of time from the past. Both tell you something about borrower behavior, and about the institution’s own practices. It does not take much for a donor to analyze both ratios jointly should they so choose. Reporting requirements are not cost-free and need careful consideration to meet the needs of multiple stakeholders efficiently.

Scott, it seems to me that the problem you’re describing with “real repayment rate” could be addressed through reporting it in dollar terms (i.e., % of dollars that were repaid on time). Regardless, I recognize that the “real repayment rate” is not a commonly used metric and there are probably multiple issues with it that I haven’t thought of.

The main thrust of this post, though, is that “real repayment rate” seems the most straightforward and intuitive interpretation of a term like “repayment rate” or “repayment ratio” – yet this term turns out to mean something extremely different, not just technically but conceptually. When I hear “99% repayment ratio,” I think “Loans are almost always getting paid back on time,” yet that turns out not to be necessarily the case at all.

I recognize that taken together, the write-off ratio and portfolio-at-risk figures can give a meaningful picture, although there is one more piece of important information – % loans renegotiated, don’t always seems to be counted either as “at risk” or as “written off” and which we have had trouble getting from applicants.

Holden,

Best practice is to treat all loans that have been rescheduled as PAR.

In addition, it’s unclear to me why paying back loans on time is of critical interest. If a borrower is a day late, does that mean they aren’t doing so well? Not really. That’s why PAR, aged into 30 day buckets, is used to assess MFIs’ financial performance but also the ability of borrowers to pay back within reasonable amounts of time. At many MFIs, borrowers go delinquent 1-30 days but are able to catch up quickly because their cash flow doesn’t map to loan products’ repayment schedules perfectly.

I think this is more of a case of choosing to make assumptions about the meaning of rates instead of actual problems with the rates themselves.

Ben

Ben,

More at our recent post on the subject.

Comments are closed.