I’ve just posted a review on the effects of alcohol taxes on alcohol consumption—and on the lives that alcohol abuse can cost. This literature review is unusual in the degree to which it replicates the studies it examines, so I have called it a “replication review.” Data, code, and spreadsheets are here.

The literature on this topic is large, and at first glance it seemed that the high-quality studies contradicted each other. Yet as I dug deeper, I found a pattern: the larger the experiment—the larger the price change—the clearer the effects. In the end, I believe the preponderance of the evidence says that higher prices do correlate with less drinking and lower incidence of problems such as cirrhosis deaths. And I see little reason to doubt the obvious explanation: higher prices cause less drinking. A rough rule of thumb is that each 1% increase in alcohol price reduces drinking by 0.5%. Extrapolating from some of the most powerful studies, I estimate an even larger impact on the death rate from alcohol-caused diseases: 1–3% within months. By extension, a 10% price increase would cut the death rate 9–25%. For the US in 2010, this represents 2,000–6,000 averted deaths/year.

Why I looked into the literature on alcohol taxation

Last November GiveWell convened a daylong meeting in Washington, DC, to gather and test ideas for priorities for our work relating to U.S. policy. (See the page about the event or Holden’s post.) One potential priority that came up—but which otherwise has hardly been mentioned on GiveWell.org—was increasing alcohol taxes:

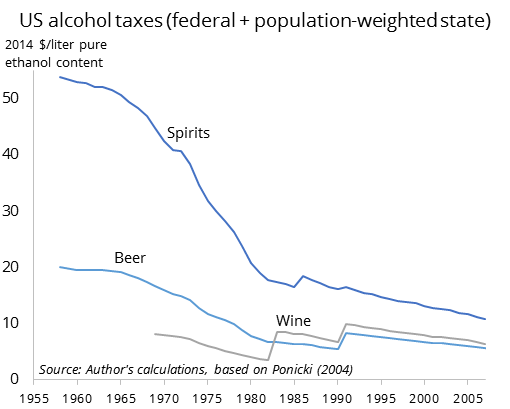

We have no particular reason to believe that the time is particularly ripe for reform in this area, but with alcohol excise taxes gradually diminishing in real terms at both the state and federal levels, it’s possible to envision work at either level.

One example of a prospect to exploit the current political environment is a successful 2011 campaign to raise alcohol taxes in Maryland. The campaign was carried out by a coalition of public health and progressive advocacy groups around the combined goal of reducing excessive alcohol consumption and increasing revenue. Many of the coalition members had previously mobilized together to support the Affordable Care Act.

The next day, Holden asked me to look into what is known about the impacts of alcohol taxes.

Alcohol taxation is not a top priority for Open Phil at the moment. Though we see the issue as uncrowded (which is promising), we see it as having only moderate importance compared to other causes we’re considering, along with highly uncertain political tractability. Nevertheless, our priorities can and do shift, and the issue seemed worth understanding better, particularly in light of the large body of studies on the topic.

My review

An excerpt from the intro:

Heavy drinking is associated with many health and social problems, including liver disease, unsafe sex, domestic violence, homicide, and reckless driving. In 2012, 28,000 Americans died from alcohol-caused diseases. Another 10,000 lost their lives in alcohol-involved motor vehicle crashes, accounting for 31% of all motor vehicle deaths… Worldwide in 2010, the death toll from alcohol-caused disease was 155,000….

Many policies affect drinking and related behaviors: criminal penalties for drunk driving, the minimum drinking age, state monopoly of retail, advertising rules, regulations on when bars can be open and who they can serve, outright prohibition, and more. In the US, alcohol taxes have hardly risen in a generation—indeed, have been drastically eroded by inflation (see figure below). In 1990, President Bush signed a deficit reduction bill that included an alcohol tax hike (visible below); thereby, Bush broke his “no new taxes” pledge, weakened his reelection bid, and helped make tax increases anathema in American politics. Conceivably, increasing taxation is now the low-hanging fruit in alcohol control policy.

But if taxes are low-hanging fruit, how nutritious are they? How certain should we be that taxing alcohol reduces consumption in general and problem drinking in particular? How much illness, physical or social, would be averted?

Many studies examine the impacts of changes in alcohol taxes or prices. Nelson (2013, Table 1) finds 578. The literature is so big that it contains a sub-literature of systematic reviews…

Few of the underlying studies attain high-quality causal identification as that term is meant today in economics, exploiting randomized treatment or strong natural experiments. Here, I focus on the minority of studies that do use natural experiments—sudden changes in alcohol taxation in certain states or countries.

Superficially, the high-quality studies contradict each other. Alcohol tax cuts apparently did not increase problem drinking in Denmark or Hong Kong, for instance, but did in Finland and Switzerland.

Yet the overall pattern across the quasi-experiment studies is that the larger the experiment—the larger the price change—the clearer the effects. The 7% tax hike in Alaska on October 1, 2002, and the 18% cut in Finland on March 1, 2004, are leading examples. The simplest and most plausible explanation for the “null” results in other contexts is that their natural experiments were too small to produce unambiguous consequences.

Overall, in my view, the preponderance of the evidence says that higher prices do correlate with less drinking and lower incidence of problems such as cirrhosis deaths. And, as I elaborate, I see little reason to doubt the obvious explanation: higher prices cause less drinking. A rough rule of thumb is that each 1% increase in alcohol price reduces drinking by 0.5% (Nelson 2013, as discussed below). And, extrapolating from some of the most powerful studies, I estimate an even larger impact on the death rate from alcohol-caused diseases: 1–3% within months. By extension, a 10% price increase would cut the death rate 9–25%. For the US in 2010…, this represents 2,000–6,000 averted deaths/year.

How much a tax-induced price increase would affect violence and traffic deaths is harder to establish from the available studies. The clearest impacts in the literature have indeed been on the death rate from cirrhosis, in part because drinking is the primary cause, in part because heavy drinkers are presumably most sensitive to price, in part because the impact can be nearly immediate, making for easier statistical detection. (Although cirrhosis is a chronic disease, it is progressive, so that a sudden increase in drinking can speed death among those in whom the disease is most advanced. Seeley 1960.) Impacts on crime, suicides, and risky sexual behavior have been reported, but have not yet been demonstrated through strong natural-experiment–based studies.

Again, the full report is here. And for an interesting sidelight on the research, see my post questioning whether moderate drinking is healthy, which touches on the interesting idea of Mendelian randomization.

As we are continuing to learn about this issue, we welcome your thoughts.

Comments

I would love to see alcohol taxes raised for the benefits discussed here- although I fear it does not have many dedicated proponents yet has well-financed opposition (the alcohol industry, bars, liquor stores).

Even liberal Massachusetts voters repealed a moderate tax on liquor in 2010. Cigarette taxes are an easier target since far fewer people identify as smokers than they do as people who drink alcohol.

Ideally it would happen at the federal level (MA stores didn’t like losing business to New Hampshire who had lower taxes) – but the Grover Norquist no tax pledge virtually ensures it will never pass until Dems gets another supermajority (2024?).

Raising taxes to stop X creates incentives for bad government behavior. You must take this bad behavior into account when deciding whether the tax is beneficial; you can’t just count the gains from stopping X.

Ken, what kind of “bad government behavior” do you have in mind, and what evidence for it? I don’t know what you mean.

For one thing, there are people in the government who benefit from either the tax revenue, or the bureaucracy that administers the tax, which creates incentives for them to expand the tax beyond what is necessary to achieve X. Also, the bureaucracy that administers the tax is now a target for lobbying groups, and lobbying can also result in expanding the tax, or creating exceptions to the tax, in ways that benefit the interests of the lobbying group but not the public.

This sounds like an argument against taxation in general, or at least against more taxation. But as Oliver Wendell Holmes observed, taxes are the price we pay for a civilized society. So we must have them. Is reason to believe alcohol taxes are more prone to such problems? Also, while I agree a tax, once in place, can become the target of lobbies wanting to distort them, I’m less persuaded that in the US bureaucracies that administer taxes are strong lobbies for them. Does Congress increase income taxes because of pressure from the IRS? Meanwhile, the main special interest distortion operating on alcohol taxes at present of course from the alcohol industry, which seeks to keep them low. The proposal to raise them in order to save lives counteracts this special-interest pressure, in spirit.

It is an argument against more taxation in general, but arguments against taxation apply to specific cases of taxation as well. “It’s not especially prone to problems, it’s just as prone to problems as normal taxes are” is damning with faint praise.

Also, the main special interest distortions acting on alcohol taxes are the government agencies that administer and benefit from the taxes.

Ken, to say that an issue might apply to all taxes is not damnation.

I stated before that I did not think the IRS lobbies for higher or more complicated taxes. You state that, “the main special interest distortions acting on alcohol taxes are the government agencies that administer and benefit from the taxes.” However, your comment contains no evidence for this assertion, so it has not shifted my thinking.

As I show in the post, the dominant trend in alcohol taxes is downward, because of inflation. That undercuts the proposition that the taxation bureaucracy rather than the alcohol industry is the dominant special interest.

The government agencies who benefit from taxation are the ones that either receive the money, or can choose whether some other group is going to receive the money.

The IRS doesn’t count. If they collect more taxes it isn’t going to increase their budget by the amount of the collected taxes, nor can they offer a government agency a share of the collected taxes in return for favorable treatment.

You say the IRS doesn’t count, so which federal agencies who benefit from the income taxes the IRS collects are trying to expand the federal income tax? Where can I see evidence of that?

I think what you’re describing sometimes happens. Look at police departments who are the beneficiaries of civil forfeiture – they often abuse and exploit their law enforcement duties and civil forfeiture laws for the benefit – usually it just brings lots of money into their small police department.

That’s not taxes, it’s law enforcement, but the evidence of abuse is there. If you have evidence of government agencies doing what you say (lobbying to expand taxes they benefit from) – I’d be interested in seeing it.

Didn’t we already try an experiment to lower drinking in this country? Prohibition. How did that work? Maybe it did decrease alcohol-related illness and death, but it also created a black market that played havoc with society. Drinking may be “sticky” in that behavior won’t change that much regardless of the hoops that people are forced to jump though: pay more, or purchase illegally. Raise taxes too much and people will buy on the black market.

P.S. to diminish use/abuse of alcohol, probably other societal factors need to be considered even more, e.g. sufficient, adequately paying jobs, for instance; health coverage that includes mental health care; etc.

Chris, David’s review analyzed a range of evidence that suggested that higher alcohol taxes were associated both with reduced sales and reduced cirrhosis mortality. This seems to suggest that not enough alcohol went “underground” to completely offset the decrease in drinking legal alcohol. I agree that outright prohibition would probably turn out badly, but it seems like moderate taxes don’t cause enough of a demand for black market alcohol to support a large industry.

Chris, I think Ajeya puts it well. Evidence trumps theory.

For me, another important referent is cigarettes. Cigarette makers are literally merchants of death. In the past and today they have fought tooth and nail against laws to reduce smoking and efforts to educate the public about the risks. Yet given the failure of Prohibition, I think it is better for the industry to be legal but strongly regulated, with high taxes on these dangerous products, limitations on advertising, labelling rules, etc.

What’s most striking about the charts is the effect of inflation, which decays away taxes defined in nominal dollars. It’s especially striking in the case of spirits, which (eyeballing your graph) look to be taxed about a factor of 5 less than they were in 1960, in real terms.

It does seem that increasing alcohol taxes would improve health (like tobacco taxes, though not as dramatic). The fact that alcohol taxes were far higher in the past is suggestive that the black market is unlikely to be a big issue even at those levels.

Other thoughts:

– Taxes (and the minimum wage and many other things) should be indexed to inflation, or at least that should be the default case. Without that, policy is in effect changing over time when that wasn’t really (typically) the intent of the legislation.

– How far should one extend the idea of specifically taxing unhealthy products? What about unhealthy foods, say refined sugars?

– Of course sales taxes are regressive. At least in principle, one could pair an increase in alcohol taxes with a decrease in other sales taxes in a revenue-neutral way.

Colin, I came here to make exactly your last point (“one could pair an increase in alcohol taxes with a decrease in other sales taxes in a revenue-neutral way.”)

Sales taxes are regressive and put brakes on the economy… except when we tax the sale of unhealthy products, which can reduce externalities and self-destructive behavior more than they reduce positive economic behavior.

So, why not put more of the share sales tax burden on say, gasoline, cigarettes, alcohol, sugars, and fries?

Have you attempted to weigh these health gains against the reduced enjoyment people would get from drinking?

Colin and Paul, yes this is a good idea in principle. In connection to environmental taxes, it has long been called “tax shifting,” and it’s what Ernst von Weiszacker meant by “ecological tax reform.” I wrote a book about that stuff back in 1998, called The Natural Wealth of Nations. E.g., see http://www.earth-policy.org/books/pb/pbch11_ss5.

Robert, no I haven’t tried weighing in the enjoyment of alcohol. Personally, I like a good root beer, so I’m not that worried about the opportunity cost.

If you raise taxes high enough, you’ll end up with a black market, as with cigarettes in New York City. This gives the government the excuse to harass people for trivial offenses. Eric Garner was strangled for selling loose cigarettes, which wouldn’t have happened without a black market.

If taxing a behavior reduces it so strongly, then it follows that income taxes reduce work and capital gains taxes reduce investment.

Lila, I look at the Garner case as primarily about excessive use of worse. It’s true what you say, but on the other hand it’s estimated (by the CDC) that smoking causes 480,000 deaths per year in the US. There’s no question that taxing cigarettes reduces smoking and saves lives.

Proving that increasing alcohol taxes reduces deaths from alcohol consumption is trivial – most people would have guessed David Roodman’s conclusion.

I think Robert Wilbin’s follow-up question is much more interesting and difficult. Unfortunately, it was dismissed with a joke.

Hi all,

This idea of raising taxes on alcohol for public health reasons is often brought up alright but I feel its proponents totally miss one key fact. Namely if you are a moderate drinker, not alcohol dependent, then no doubt increased alcohol taxes will probably lead you to cut back a bit. But (and this is a very big but) for those who are alcohol dependent then if they are faced with a rise in the cost of alcohol they are not going to cut back on their drinking in the main but on other stuff instead like food etc. to make up the money. A tax rise on alcohol will especially hit low income families who may have a father or mother who are alcoholics. The point of being an alcoholic is that unfortunately you find it extremely difficult to exert any kind of restraint over your drinking. So when money gets tight you’ll sacrifice everything else but considering cutting back on alcohol

Robert, do you have any evidence for that assertion?

Because you can also argue the other way, that heavy drinkers will be responsive to price because they’ll pay more tax in absolute terms. Which effect dominates is an empirical question.

Several studies I review seem to contradict it. My reading of Gmel et al. (2007) is that that “in the long run, price changes affect heavy drinkers about as much as the general population.”

And the Finland data showing a sharp increase in cirrhosis deaths after the tax cut there, also graphed in my review, point to heavy drinkers responding to price, since they’re predominantly the ones who die of cirrhosis.

Also see the big graph in the blog post on my personal website.

This doesn’t mean that no people behave the way you describe. But it doesn’t look like they’re the majority.

Comments are closed.