This is the second post (of six) focused on our self-evaluation and future plans.

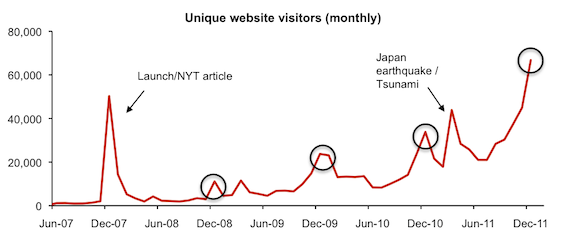

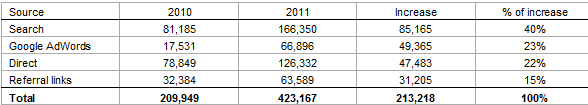

This post lays out highlights from our metrics report for 2011. For more detail, see our full metrics report (PDF).

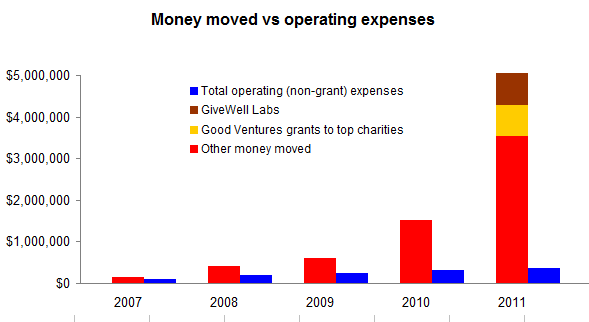

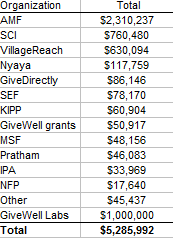

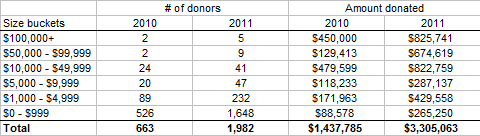

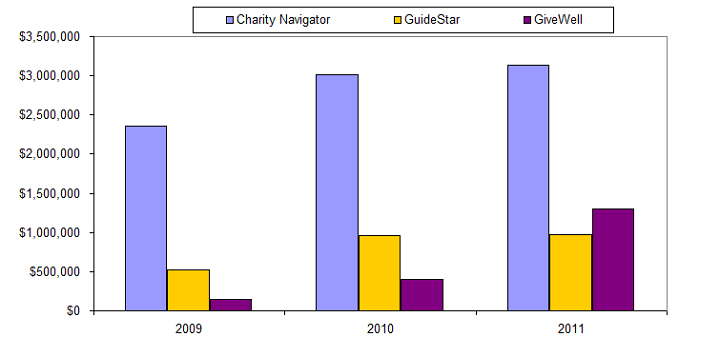

1. In 2011, GiveWell moved $5,285,992 to our recommended charities, a significant increase over past years.

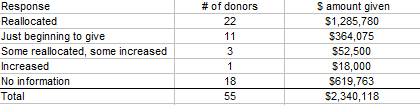

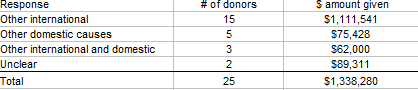

Good Ventures grants to our top charities as well as funding to committed GiveWell Labs accounted for approximately 1/3 of our total money moved ($1.75m / $5.3m). Excluding those funds entirely, 55 donors giving $10,000 or more accounted for 70% of our money moved. In the table below, and in the following analyses of our 55 largest donors, we exclude funding from Good Ventures to our top charities and funding committed to GiveWell Labs.

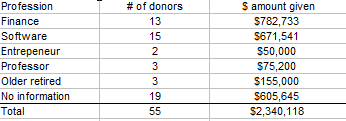

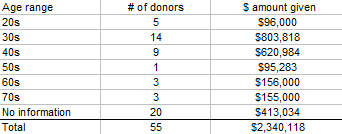

6. These 55 donors tend to be (a) young (for major donors) and (b) most often employed in finance or technology. Close to 80% of our money moved (about whom we have information) comes from donors who are under the age of 50; approximately 45% comes from donors under the age of 40. (Note that we did not always know donors’ ages and, in some cases, made our best guess.)

Comments

Applause applause! Congratulations on wonderful growth, not because growth for growth’s sake is always good, but because you are obviously providing a service more and more givers want.

In a sense, I find the “money moved vs. operating expenses” graph slightly ironic; it seems that spending more on operating expenses (i.e. hiring more research analysts) would effect an increase in the quality of GiveWell’s research—I suspect that you would agree here. In light of earlier postings which highlighted GiveWell’s openness to hiring more full- time staff, and the fact that GiveWell must expand its research as it receives more funding, I wonder how valuable more capacity for research, as opposed to more funding, is to GiveWell.

To put the question in more practical terms, at what point would it be more valuable to GiveWell to have another donor, rather than another research analyst—if someone currently working as, say, a hedge fund manager were able to donate x dollars per year to GiveWell’s top charities, then at what x would it be more valuable to GiveWell to have this person as a major donor, rather than as a research analyst at GiveWell? (Let us assume that this person would be a reasonably competent research analyst.) Granted, this question can by no means be answered precisely, but what are your thoughts on general on this?

Has the Board regarding GW’s 2011 operating expenses decided at anytime to implement “excess assets” policy?

Your chart showing growth in money moved over time is astounding. I can’t imagine a lot of businesses can claim to be growing at a rate of 100-200%/year. A tremendous achievement!

Jacob:

We don’t mean for the operating expenses vs money moved chart to indicate that we are scrimping on operating expenses. As our annual review and plan indicates, we are actively hiring for the research analyst role. We regard our capacity as being limited more by our ability to recruit quality candidates for that role than by money.

For college students making a decision between an offer from GiveWell and one that would allow them to be a “professional donor,” we generally believe that working for GiveWell would be the more impactful career choice. Of course, the answer to this question will depend on the specifics of the person and roles in question. For more senior people it is even harder to give a general answer; it really depends on the specifics of what the person could bring to GiveWell and what they would do otherwise.

Chuck:

GiveWell’s excess assets policy has been triggered once, in 2009. Since then, it has not been triggered, partly because we’ve advised donors to give to our top charities rather than to GiveWell directly once we’ve reached a certain level of operating support (a level short of what would be needed to trigger the policy).

Brigid & Jason:

Thanks!

Comments are closed.